The Ultimate Guide to Investing in Real Estate for Beginners

Real estate is one of the most powerful tools for building long-term wealth. Whether you’re dreaming of owning rental properties, flipping homes, or diversifying your income, this beginner’s guide will walk you through everything you need to get started — with clarity, confidence, and strategy

1. Understand Why Real Estate is a Smart Investment

Real estate stands out from other investment options because it offers both stability and growth potential. It can generate steady cash flow, appreciate over time, and provide tax advantages that other assets don’t.

2. Know the Types of Real Estate Investments

Before investing, it’s essential to know your options.

- Residential Properties: Single-family homes, condos, and townhouses

- Multi-Family Units: Duplexes, triplexes, and apartment buildings

- Commercial Properties: Offices, retail stores, and warehouses

- REITs: Real Estate Investment Trusts (stocks backed by real estate assets)

3. Set Your Investment Goals

Ask yourself:

Do I want monthly cash flow or long-term growth?

Am I investing for retirement or quick returns?

Will I manage properties or hire help?

Your goals will shape your entire strategy.

4. Learn the Numbers That Matter

Real estate success is about more than just finding a good-looking property — it’s about understanding the math.

Key metrics to know:

- ROI (Return on Investment)

- Cap Rate (Capitalization Rate)

- Cash-on-Cash Return

- Rental Yield

5. Choose the Right Location

The right location can mean the difference between profit and loss. Look for:

- Population growth

- Job opportunities

- Schools and transit access

- New development

- Low crime rates

6. Start Small and Learn as You Go

Many successful investors start with a single-family home or a small rental unit. It’s less risky, easier to manage, and gives you room to learn.

7. Secure Financing the Smart Way

You don’t always need a lot of cash upfront. Financing options include:

- Traditional mortgages

- FHA loans

- Hard money lenders

- Private money or partnerships

8. Build Your Dream Team

A strong team can make or break your investment. Include:

- Real estate agent

- Mortgage broker

- Property inspector

- Attorney

- Contractor

- Property manager (optional)

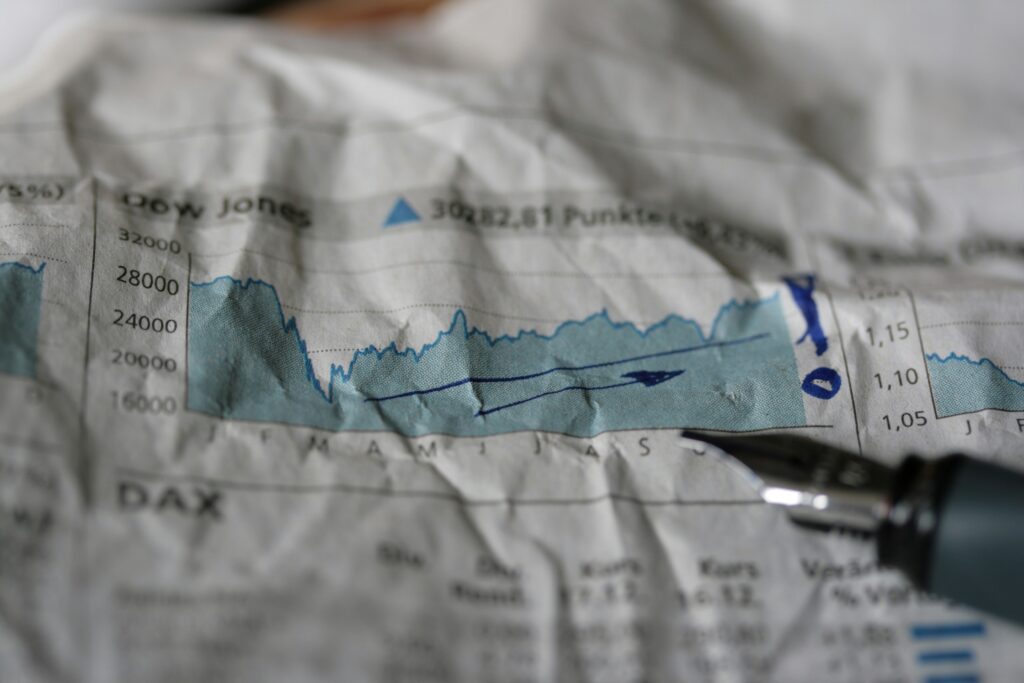

9. Know the Risks and How to Avoid Them

Every investment has risk — but you can manage it.

- Always inspect before buying

- Keep a reserve fund

- Vet tenants carefully

- Don’t overborrow

- Stay updated on market trends

10. Think Long-Term

Real estate builds wealth gradually. Focus on:

- Positive cash flow

- Loan paydown

- Property appreciation

- Tax deductions

Final Thoughts

Real estate investing isn’t about getting rich overnight — it’s about growing your wealth consistently and securely. As a beginner, start small, learn continuously, and build your foundation carefully.

EXPO44 helps new investors access elite opportunities in residential, commercial, and luxury real estate. Let’s start building your future today.